XPeng Inc. (NYSE: XPEV) is one of the most actively discussed electric vehicle (EV) stocks among global investors. With dramatic price swings, ambitious technological goals, and a rapidly evolving EV market, many traders are asking: Is XPeng a good stock to buy? This article breaks down the key factors including recent XPeng stock price, NY-listed performance, long-term predictions, and reasons behind recent price drops.

What Is XPeng and Its Business Model?

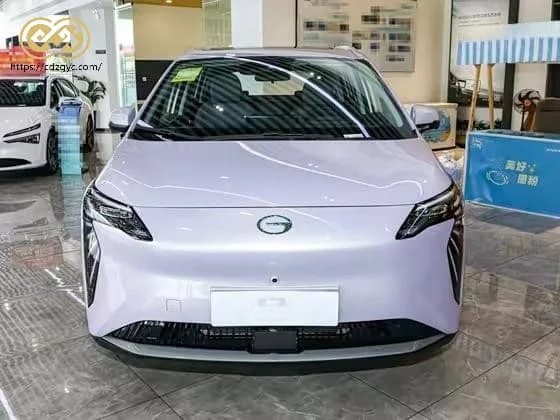

XPeng Inc. is a Chinese electric vehicle manufacturer focusing on smart EVs, autonomous driving technologies, and broader mobility innovations. The company has increasingly positioned itself not only as an EV maker but as a technology-driven mobility firm, with areas such as robotaxi solutions and humanoid robotics under development.

Being listed on the New York Stock Exchange (NYSE) as XPEV, XPeng’s stock performance is closely watched by global investors. The stock’s price moves reflect not only company fundamentals but also broader EV market trends.

XPeng Stock Price Today and Recent Trends

As of the latest available data, XPeng stock is trading around $20–21 per share on the NYSE, reflecting recent volatility.

XPeng’s share price has moved notably over time — experiencing robust rallies followed by pullbacks — signaling both investor optimism and caution. This volatility reflects several underlying factors, including mixed earnings results, shifting EV demand, and broader market sentiment.

Why Has XPeng Stock Been Dropping?

Competitive Pressure and Weak Revenue Forecasts

XPeng’s stock has faced selling pressure due to several key reasons:

-

Weaker-than-expected revenue outlooks: When quarterly revenue projections fall short of forecasts, stock prices often dip as investors reassess growth expectations.

-

Intense price competition in China’s EV market: Rivals like BYD and other Chinese manufacturers have aggressively priced vehicles, pressuring XPeng’s margins.

-

Changes in China’s EV incentives and tariffs: Adjustments to tax exemptions and export requirements can disrupt foreign sales strategies.

Broader Market Sentiment

In addition to company-specific issues, macroeconomic forces like slower consumer spending, weak domestic demand, and high interest rates have weighed on Chinese equities, including XPeng.

Despite these headwinds, some technical indicators have shown renewed strength in recent weeks, suggesting momentum could shift if supported by strong earnings growth.

XPeng Stock Price Prediction 2030

Long-term stock forecasts vary widely among analysts and prediction models:

According to some forecasts:

-

XPeng’s price might range between $1.57 and $11.49 by 2030, suggesting significant potential downside compared with current levels.

-

Earlier projections also cited potential prices around $8.29–$13.60 by 2030 under different scenarios.

These projections reflect moderate to bearish long-term sentiment, largely due to competition, market saturation, and profitability uncertainty. Such price predictions are not guarantees and vary widely based on methodologies.

Fundamental Strengths of XPeng

Growing Deliveries and Market Expansion

XPeng continues to deliver strong growth in vehicle deliveries — including international sales. Delivery figures have shown triple-digit percentage growth year-over-year in recent months, driven by models like MONA and international expansion strategies.

Technology and AI Focus

The company’s emphasis on autonomous driving, in-house AI chips, and future mobility (robotaxi and advanced robotics) sets it apart from some peers. These innovations could create long-term revenue streams beyond pure EV sales.

Risks to Consider Before Buying XPeng Stock

Investors should weigh several risks:

-

Profitability challenges: XPeng has yet to consistently post net profits and invests heavily in R&D.

-

EV market competition: Major rivals include Tesla, BYD, and other Chinese EV manufacturers.

-

Market valuation concerns: Some analysts consider XPeng overvalued based on current sales multiples.

Should You Buy XPeng (NYSE: XPEV)?

There’s no one-size-fits-all answer — but here’s a balanced view:

Potential Pros:

-

Rapid delivery growth and strong technology roadmap.

-

Strategic partnerships (e.g., with Volkswagen and platform collaborations).

-

Renewed technical strength in stock performance.

Potential Cons:

-

Forecasts suggest a possible long-term price decline relative to current levels.

-

Competitive pricing pressures and market headwinds.

-

Earnings volatility and mixed investor sentiment.

Summary: XPeng may suit long-term, risk-tolerant investors who believe in the company’s innovation strategy, but those focused on short-term gains or stable income may prefer more established names.

Frequently Asked Questions (FAQ)

Q1: Is XPeng stock overpriced right now?

Short-term valuation depends on market sentiment, but many long-term models suggest XPeng has significant downside risk — implying current prices may be high relative to projected future earnings.

Q2: Why is XPeng stock dropping even with strong deliveries?

Despite strong delivery growth, revenue forecasts, pricing pressure, and macroeconomic factors have driven selling pressure.

Q3: How far could XPeng stock fall by 2030?

Some forecasts show prices potentially below current levels by 2030, though this is not certain and varies by analytical model.

Q4: Does XPeng pay dividends?

As of now, XPeng does not pay dividends. Most EV growth companies reinvest capital into expansion and innovation instead.

Q5: Should beginners invest in XPeng?

Beginners should be cautious — consider consulting a financial advisor, understanding volatility, and focusing on risk tolerance before investing.